Ngabo Yo offers a wide range of products and services in order to support SMEs in their business in the domestic and international market.

Ngabo Yo Starting From UGX5,000 Monthly

Pays you over UGX12,500,000/= in cover!

- UGX5,000,000 - Main Member (Yourself)

- UGX2,000,000 - Spouse (Only 1 Spouse)

- UGX500,000 - Per Child or Dependents (Up to a maximum of 4 children or dependents)

- UGX500,000 - Per Parent (To a maximum of 2 parents)

- UGX500,000 - Per Parent-in-Law (Upto a maximum of 2 parents-in-law)

- UGX2,000,000 - Permanent Total Disability of Main Member

- UGX2,000,000 - School Fees Benefit to the children or dependents upon death of Main Member (one-off)

Frequently Asked Questions

Either way, your password will be changed and in this article we will be explaining the two ways to have it changed.

TIPS FOR CREATING A SECURE PASSWORD

Having a secure, unique password for each of your online accounts is critically important. If a scammer gets just one password, they can begin to access your other accounts. That’s why it’s important to have a strong, unique password for your Ngabo Yo login.

A strong password should have the following characteristics:

- More than 8 characters long

- Use lower case, upper case, a number, and a special character [like ~!@#$%^&*()_+=?><.,/]

- Not a word or date associated with you (like a pet's name, family names, or birth dates)

- Use a password that you'll be using only for your Ngabo Yo account

- A combination of words with unusual capitalization, numbers, and special characters interspersed. Misspelled words are stronger because they are not in the dictionary used by attackers.

- Keep your password secret. We'll never ask for your password by email, instant message or phone

- Something you can remember

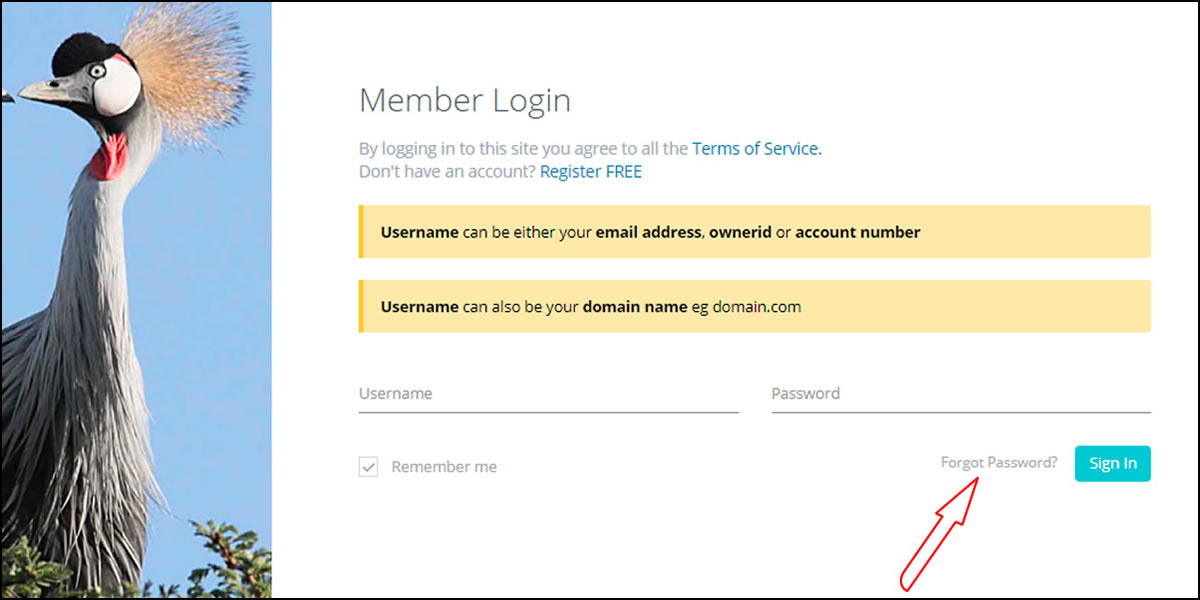

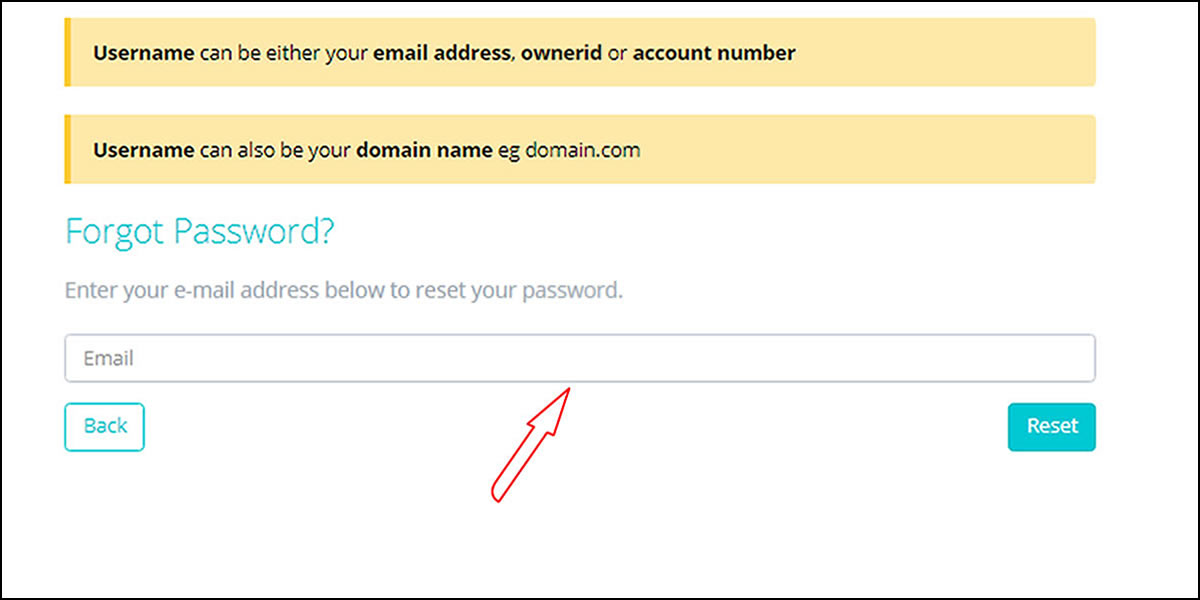

RESET YOUR PASSWORD ON THE LOGIN PAGE

- Go to the login page and click on forgot password as shown in the attached figure below

- Enter the email address associated with your Ngabo Yo account for you to receive the reset password

- Login to the respective email address and look for the reset password that has been sent to it

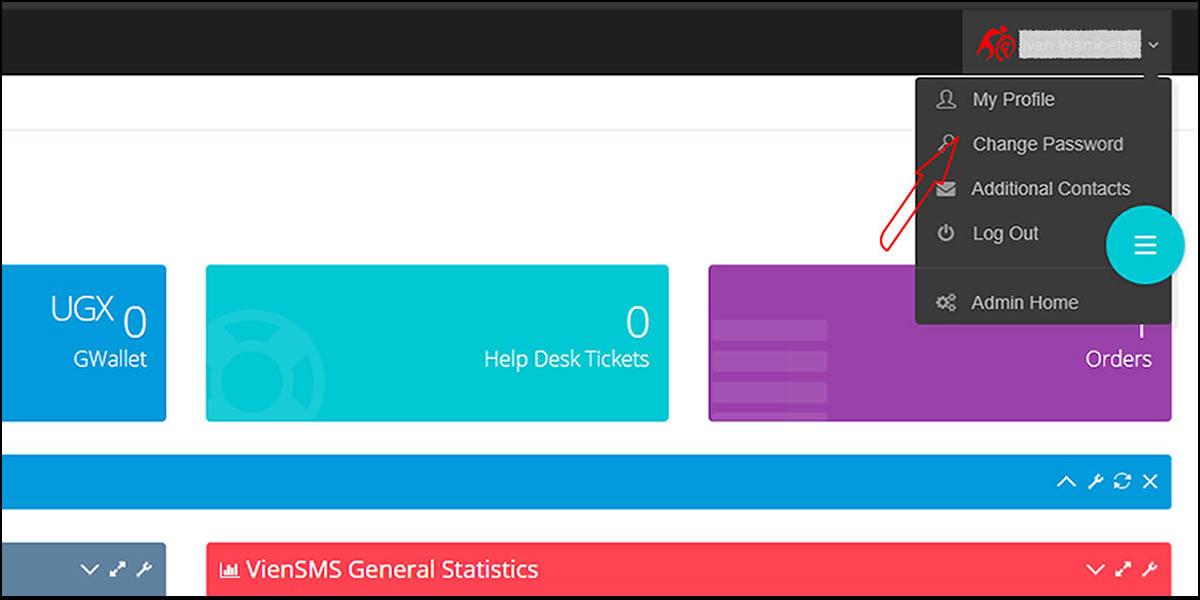

CHANGE PASSWORD THROUGH YOUR ACCOUNT

Navigate to the top right hand corner and click on your name to open a menu as shown in the figure below.

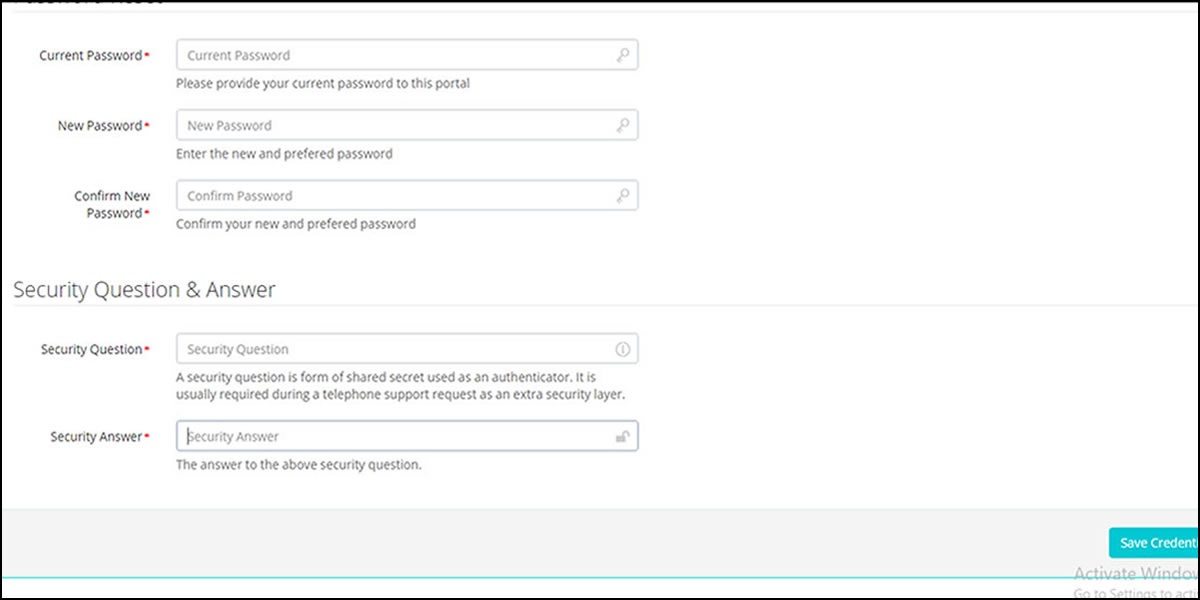

Click Change Password

If you can't remember your old password, you can reset it on the login page and check the email associated with your Ngabo Yo account for the reset password.

Click Save Credentials How to fix common issues that can affect the password reset process I can't find the password reset email in my inbox

If you have asked the system for a password reset and after a couple of minutes you still haven't received the password reset email:

- Please ensure to check your spam/junk folders in case the email has been filtered out.

- Some email software sends filtered emails to their "deleted folder" or "waste bin" even though they also have a spam folder, so make sure to check there as well.

- If you do find the email in any of these folders, please make sure to whitelist our email address.

If you have asked the system for a password reset and after a couple of minutes you don't have the email in inbox nor in junk/spam/deleted folders:

- It might be better to wait at least 5 or 10 minutes rather than try requesting another password reset right away. This is in case your email provider is experiencing a delay in processing the email our system sent.

- If you do decide to try requesting a new password reset email without having received the first one, please keep in mind that you might first receive the previous password reset email. In this case, the first email will have an expired password, because the reset passwords expire as soon as a new password reset is requested. Make sure to always use the absolute last password reset email you have received.

We recommend you change your password and security questions from time to time. There are a few cases where it's a good precaution, for example:

- You notice something suspicious on your Ngabo account

- You suspect that someone you don't trust has your password

- You notice something suspicious in your email account or other online accounts

- You have recently removed malware from your system

- Ngabo asks you to change your password

If one of these occurs, change your Password, PIN, and security questions immediately. You can change these under personal settings.

If you receive an email asking you to change your password, it could be a case of phishing. Instead of clicking on a suspect link in an email, just log into your Ngabo account by manually typing the URL. Click the Settings tab, and then Personal Info. You will find the password, security questions, and PIN (if you've set one up) on this page.

Below you will find some of the types of accounts that you can be able to open up and the required documents for each. You can jump to particular sections of these documents by using the following links below:

- Individuals

- Limited Companies

- Sole Proprietor

- Savings and Credit Cooperatives (SACCOs)/Non-deposit taking microfinance institutions/ /Money Lending companies

- Non-Governmental Organizations

- Community based organizations, Clubs and Associations

- Faith Based Organizations – Churches, Mosques etc

- Schools, Education Institutions

- Partnerships

- Embassies

- Trusts

- Political Parties

- Ministries/Public Sector/Government

- Banks Financial Institutions

- Why should you submit your documents?

- How do you submit documents to Ngabo Yo?

What kind of documents can you submit to Ngabo Yo?

INDIVIDUALS

The following documents are required to be submitted by the applicant in the process of creating an account for individuals

- Identification Documents (Acceptable IDs)

- National IDs, Passports, Employment ID, Driver’s License and NSSF Card. Preferred ID ➢ National ID

- Passports are the ONLY acceptable form of identification proof for foreign nationals and Work Permit/Certificate of residence

- FATCA form for US Nationals

- Refugees: Refugee ID Minors: The minor’s information, birth certificate/Health cards and photos must be obtained. While the minor’s Guardian who will operate the account MUST provide Individual requirements

- Students: National ID/Student ID

- Proof of residence/ address verification include any of the following

- Letter from a public authority or embassy or consular office

- Utility Bills in the customer’s name and not older than 3 months

- Where utility bill is not in the name of the customer obtain a copy of the tenancy agreement

- Letter of recommendation from employer

- LC Letter confirming residence

- Letter from School/ University administration in case of students

- Bank statement from existing or previous bank bearing the current customer’s address.

- Certificate of residence for foreigners

- Proof of Income/Source of Income

- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

The following documents are required to be submitted by the applicant in the process of creating an account for Limited Companies

- Certified board resolution to open account stating authorized signatories

- Certificate of Incorporation certified by the Company Registrar

- Certified Memorandum and Articles of Association

- Certified Particulars of Directors and Secretaries i.e. Form 20 (formerly form 7)/Notification of change of directors and company secretary

- Certified copy of Particulars of Business Address i.e Form 18 (formerly form A9)

- Trading License. A company licenced under a different law, should submit a copy of the applicable license

- Tax Identification Number (TIN), or Tax Exemption Certificate

- Company search

- Identity Documents of related parties and beneficial owner.

A beneficial owner is an individual with shareholding > 10%, A related party is a Director and authorized Account Signatories.- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

The following documents are required to be submitted by the applicant in the process of creating an account for sole propretors

- Certificate of registration of Business Name Certified by the Company Registrar

- Statement of particulars pursuant to the registration of business name

- Trading License

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for SACCOS

- Certified copy of the certificate of registration of the SACCO issued under Cooperatives Societies Act

- License from Tier 4 Microfinance Institutions Authority

- Constitution/ By Laws or Certified Memorandum and Articles of Association of the entity

- Identity Documents of Primary and related parties such as Directors and Account Signatories. (National ID for nationals OR Passport for Foreigners OR Refugee ID for refugees)

- Minutes authorising account opening and appointing current management and signatories

- Letter requesting for account opening stating signatories

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office.

- Proof of Address i.e. Certified copy of company form 18 (formerly A9)

The following documents are required to be submitted by the applicant in the process of creating an account for NGOs.

- Certified Copy of License from the NGO board

- Certified copy of Certificate of Registration/Incorporation

- Constitution/ By Laws Or Certified Memorandum and Articles of Association

- Registered resolution indicating the current Board members/Executive committee & period of validity in office. In case of any change another resolution and Minutes electing the current sitting Board should be shared

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- National IDs, Passports, Employment ID, Driver’s License and NSSF Card. Preferred ID > National ID

- Passports are the ONLY acceptable form of identification proof for foreign nationals and Work Permit/Certificate of residence

- FATCA form for US Nationals

- Refugees: Refugee ID Minors: The minor’s information, birth certificate/Health cards and photos must be obtained. While the minor’s Guardian who will operate the account MUST provide Individual requirements

- Students: National ID/Student ID

The following documents are required to be submitted by the applicant in the process of creating an account for CBOs, Clubs and Associations

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Minutes of meeting resolving to open the account and stating signatories

- Constitution/ By Laws or Certified Memorandum and Articles of Association

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

- Proof of Address i.e. Certified copy of company form 18 (formerly A9)

The following documents are required to be submitted by the applicant in the process of creating an account for FBOs, Churches and Mosques

- A recommendation letter to open an account from the Vicar/Secretariat of the religious faith for the mainstream churches/mosques

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Constitution/Charter

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for Schools, Education Institutions

- School Registration Certificate issued by Min of Education & Sports for private institutions

- License from the Ministry of Education for private institutions

- Authorization to Open account duly signed by District or Town representative (CAO or District Education Officer or Town Clerk) OR Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for partnerships

- Certified Certificate of Registration

- Certified copy of Partnership Deed

- Certified Statement of particulars pursuant to the registration business name.

- Authorization to Open account duly signed by Partners stating signatories.

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees).

- Tax Identification Number (TIN), or Tax Exemption Certificate where applicable

- Trading/Operating License.

- Proof of Address any of the following below can be obtained;

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for Embassies

- Authorization to Open account duly signed by the Ambassador stating Signatories.

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees).

- Proof of Address any of the following below can be obtained;

- Recent Utility bills not older than three months,

- Bank Statement bearing customer’s address.

- Tenancy or Lease Agreement

- Letter of authorization to open account indicating address on letterhead

- Tax Identification Number (TIN), or Tax Exemption Certificate

- Group Sanctions Desk Authorisation

The following documents are required to be submitted by the applicant in the process of creating an account for individual

- Certified Certificate of registration

- Certified copy of Trust Deed

- Certified Resolution/ Authorization to Open account stating signatories

- Identity Documents of persons having senior management positions or trustees of the trust, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

The following documents are required to be submitted by the applicant in the process of creating an account for Political Parties

- A certified copy of their registration Certificate from the Electoral Commission.

- A certified copy of the party Constitution that is filed with the Electoral Commission.

- A Resolution of the party to open an account stating signatories

- Identity Documents of the Party President, Secretary General and Treasurer of the party and account signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees).

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- Letter of authorization to open account indicating address on letterhead

The following documents are required to be submitted by the applicant in the process of creating an account for ministries/public sector/government

- Letter requesting for opening of account signed by: Town Clerks/Permanent Secretaries/Chief Administrative Officer (CAO)/Executive Directors stating signatories

- Letter of authorization for account opening from the Accountant General or Board of the Public-Sector entity.

- Identity Documents of Directors and Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Letter of Authorisation indicating address

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- Proof of residence/ address verification include any of the following

- Letter from a public authority or embassy or consular office

- Utility Bills in the customer’s name and not older than 3 months

- Where utility bill is not in the name of the customer obtain a copy of the tenancy agreement

- Letter of recommendation from employer

- LC Letter confirming residence

- Letter from School/ University administration in case of students

- Bank statement from existing or previous bank bearing the current customer’s address

- Certificate of residence for foreigners

- Proof of Income/Source of Income

- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

BANKS/FINANCIAL INSTITUTIONS

The following documents are required to be submitted by the applicant in the process of creating an account for Banks/financial institutions

- Certified Certificate of Incorporation (Notarised for foreign banks)

- Certified List of Directors and Secretary/Trustees i.e. Form 7/20 (Notarised for foreign banks)

- Certified Memorandum and Articles of Association. (Notarised for foreign banks)

- Latest Annual Report

- Valid Operating License issued by the respective regulator

- Profile of Senior Management and Board

- Proof of Address i.e. Certified copy of company form 18 (formerly A9) or License indicating address for foreign banks/extract from the regulators website indicating the bank’s address

- Certified Board Resolution/ Authorization to open account/SWIFT request for foreign banks

- Tax Identification Number (TIN), or Tax Exemption Certificate / W8-BEN form

- Copy of the AML policy

- Wolfsberg Questionnaire (Not older than 6 months)

Why should you submit your documents to Ngabo Yo?

- They act as proof of Identification

- They help protect your funds

Attaching and submitting your documents to Ngabo Yo is so easy. The following are the instructions to guide you on how to submit your documents

- Login to your Ngabo Yo Account

- Navigate and click on your name at the top right hand corner

- Select my profile from the drop down menu

- Locate and click on the documents tab

- Navigate and click on the Add button

- Enter the details such as the subcategory, document name and some comments

- Click on Save Document

Submitting a Ticket Request

When it comes to getting support from us at Ngabo Yo, submitting a support ticket is one of the best ways to request assistance. To help with this task, it can be helpful to realize the way that our ticketing system works.

In this article we'll go over the types of support requests, the differences between support requests, checking on the status of a support request, submitting a support request, adding details to a support request, and finally what we see when you submit a support request

Types of Support Requests

When submitting a support request, there are three different types of requests:

- Non-verified question to our Customer Community: A Non-verified question means that we will look into and respond to your issue in our public Q&A section of our website. These are typically for questions outside of the general scope of our Support Team.

- Verified ticket submitted through AMP: This method is the easiest way to contact Technical Support. It is preferred because it provides a contact that does not require further verification.

- Non-verified email to support@jolis.net for Technical Support, or to billing@jolis.net for Customer Service Support: A Non-verified email means you might have to confirm your account with either the current AMP password for your account or just the last 4 digits of the credit card on file.

Verified vs. Non-verified Support Requests

The main difference between a Verified and Non-verified support request comes down to the information we can relay to you, as well as any account changes that we can make for you.If you just need to ask us a quick general question a Non-verified support request is fine. We will be able to provide general assistance (without making changes to your account) and will not divulge any account specific information. However, if your request requires that we give you specific information about your account or make any adjustments on your behalf, you must submit a Verified request.

Submit a Support Request

When you need to submit a Support request to us there are two (2) methods you can use to submit a ticket.Submit a Verified Ticket from AMP

- Log into [[UN]] Account.

- Navigate to Help Desk under Help & Info.

- Click the Submit New Ticket button

Submit a Non-verified Ticket via Email

If you would like to submit a Support request to us, by sending an email, you can simply send an email to us at support@jolis.net.Simply provide either your account’s current AMP password or just the last 4 digits of the credit card on file in the body of your initial email to verify your account.

Checking a Support Request Status

Once your initial request is received a ticket is created and queued. We answer all tickets in the order that they are received. There are only three possible statuses for tickets: open, hold or closed. While the ticket is in queue and/or being worked on, the status is open. Once a technician responds to your request, you will receive an email and the ticket will be closed. This email includes the technician’s response and the complete email thread (beginning with your initial request). When you reply to their email, the ticket is reopened with your response and again, handled in the order it was received.Request Submitted

What You See

After you submit a ticket, you should receive a confirmation email from our system with your ticket ID.Now you just need to wait while we review your support request in our ticketing system. You will get an email from us again once one of our support staff replies to your ticket. In this case they responded with the text “Staff response”.

What We See

When you first submit your ticket, it will be assigned to our Tier1 Support Team to investigate further.Adding Details to an Open Ticket

If you need to add more details to your support request, you can simply reply to the email you receive from our ticketing system without altering the subject.Need Immediate Help?

As always we are here to help, so if for some reason you need immediate assistance with your support request please start a Live Chat session with us or give us a call at 0800-1-JOLIS(56547).Ngabo yo provide comprehensive insurance cover to protect your family's future to ensure that they lead their lives comfortably without any financial worries, even in your absence. Long-term Financial Security. Customizable Life Cover. Terminal Illness Cover. Optional Accidental Death & Disability Cover.

Ngaboyo insurance starts from UGX5000 monthly. Your individual premium will depend on your own needs and circumstances.

It depends on your individual circumstances. You may want to think about leaving a lump sum to your dependents or help clear an outstanding loans if you die.

The cost of life insurance is affected by lots of things, including your health, age and whether you smoke. One of the key drivers is the rates of death and sickness over the duration of the policy